While the discussion focused on the risks to attorneys and other professionals in accepting payment in Bitcoin, most of the points Ms.

DOES BITPAY REPORT TO IRS FULL

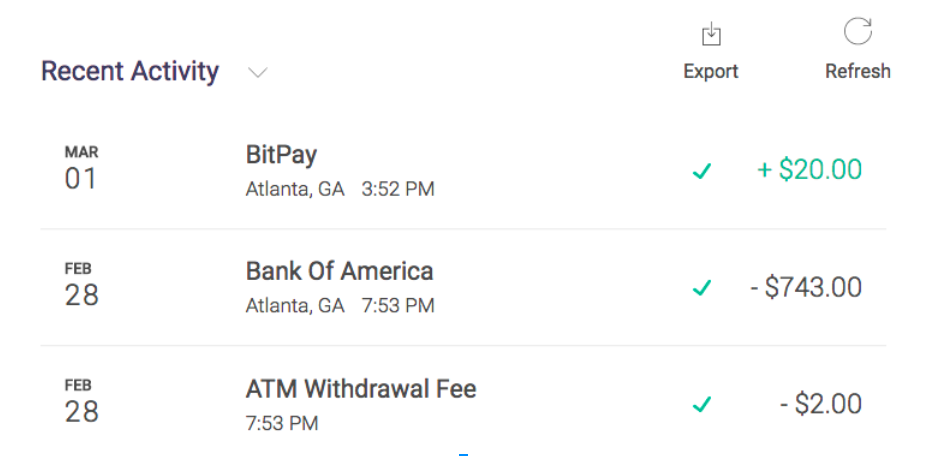

To gain a better understanding of the risks involved in accepting payment in Bitcoin, Anderson – principal of David Anderson & Associates, a Philadelphia forensic accounting firm that provides a full range of fraud investigation and fraud deterrence programs in the Delaware Valley – interviewed Philadelphia federal criminal defense and white-collar crime attorney NiaLena Caravasos ( ). Along the way, Bitcoin’s dollar price has experienced rises and falls of up to several hundred dollars in a day. During the past year, Bitcoin has increased from $600 per Bitcoin to over $4,900 per Bitcoin. ATM withdrawals are limited to $3,000 per day.Īs of August 2017, there were 838 ATMs in the United States which facilitated Bitcoin transactions out of a worldwide total of 1,515 ATMs.īitcoin prices are not regulated by any country, and can fluctuate significantly. Cardholder fees include a network use fee of approximately 5 percent a currency conversion fee of 3 percent, ATM fees of $2 to $3 per transaction, and card loading fees of up to $5 per loading. BitPay, which provides the user with a prepaid VISA card.Currency conversions incur an addition 0.5 percent fee. All purchase or sales of Bitcoin incur a 4 percent transaction fee. , which requires you to link your credit card, debit card, and/or bank account to their service.

ATM withdrawals of cash are limited to $3,000 per day. charges an 8 percent fee to sell you Bitcoin and a 4 percent fee to buy your Bitcoin.

One can then make payments in Bitcoin for goods and services to vendors who accept Bitcoin, or one can convert Bitcoin to currency from a Bitcoin buyer. To obtain Bitcoin, one must set up a digital wallet and then purchase Bitcoin from a Bitcoin seller. Additionally, their value is not tied to any specific currency. Without getting too deep into the technical details, Bitcoin is a cryptocurrency, meaning it essentially exists electronically, relies upon electronic or digital wallets and electronic public ledgers to record transactions, and – because Bitcoins are associated with secure and private electronic addresses instead of identified digital “footprints” – Bitcoin transactions are anonymous. However, just because these companies do, should you accept payment in Bitcoin? This week’s blog by Certified Fraud Examiner Anderson will seek to answer that question. Blog Bitcoin: The New Way to Receive Payment, Or Trouble in The Making?ĭavid Anderson is principal of David Anderson & Associates, a Philadelphia forensic accounting firm that provides a full range of fraud investigation, forensic accounting, and marital dissolution services in Philadelphia and the Delaware Valley.īitcoin and other digital currencies (such as Litecoin, Ethereum, Dash, and Dogecoin, among more than 700 others) often are described as the future of monetary transactions.īitcoin, said David Anderson, principal of David Anderson & Associates, a Philadelphia forensic accounting firm that provides a full range of fraud investigation and fraud deterrence programs in the Delaware Valley, is the most well-known of the digital currencies, and is accepted as payment by such companies as Microsoft, Expedia, Newegg, Intuit, and PayPal.

0 kommentar(er)

0 kommentar(er)